Child Tax Credit Portal

Another tool the Child Tax Credit Update Portal will initially enable. Advance Child Tax Credit Payments in 2021.

Irs Child Tax Credit Portals Add Bank Account Info Opt Out And More Cnet

Irs Child Tax Credit Portals Add Bank Account Info Opt Out And More Cnet

The portal should allow parents to update their tax information and specify which parent should receive the advanced payments so that one parent is not getting the tax credit.

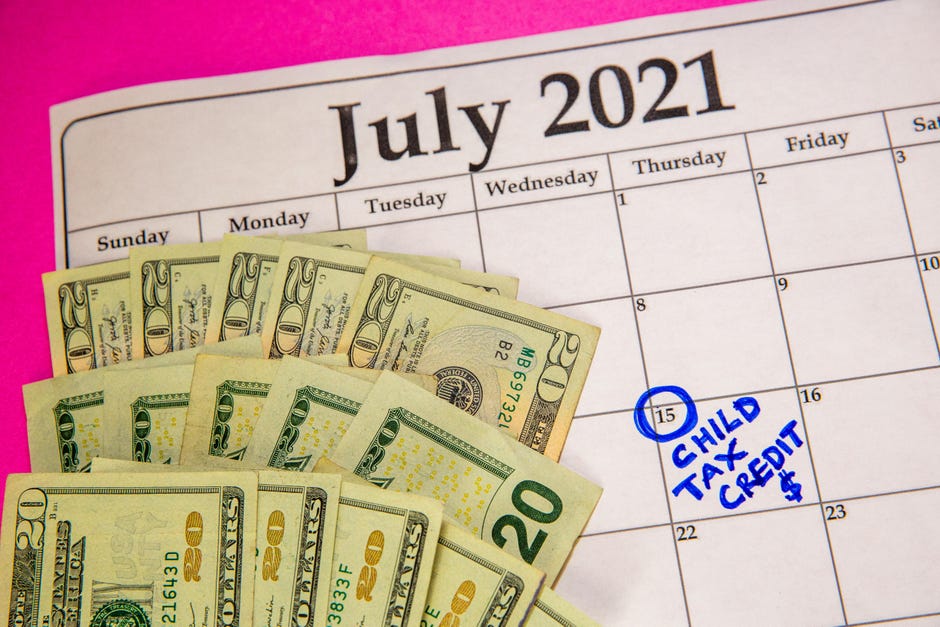

Child Tax Credit Portal. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. New Stimulus Check.

We took a look at the question is the web portal the best way to. The first a Child Tax Credit Update Portal allows families to check if they qualify for the credit and also gives them a choice of opting out of receiving any payments this year. New parents can use the Child Tax Credit Update Portal to check eligibility and unenroll.

The IRS has updated an online tool that will allow taxpayers to update their banking information in order to receive the tax. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. -As of 1 July millions are eligible for tax credits to reduce the cost of health insurance.

The first section will say Manage Your Advance Payments of The Child Tax Credit. 2nd child tax credit portal now open About 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit. In 2021 the maximum enhanced child tax credit is 3600 for children.

An interactive Child Tax Credit eligibility assistant to help families determine whether they qualify for the payments. You will claim the other half when you file your 2021 income tax return. The next deadline to unenroll is Aug.

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. If you have not received your renewal pack by 4 June 2021 contact HMRC. This is the Direct Deposit portal section and by.

If you opt out now youll receive the child tax credit money in one lump sum with next years tax return. Renew your tax credits by 31 July 2021. Parents will soon benefit from an expanded tax credit for children.

The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out. But cutting child poverty in half means getting money to those hardest to reach. The Biden administration has extended the Child Tax Credit for 2021 meaning that parents can receive a credit up to 3000 for every child aged between six and 17.

The IRS Has Unveiled Its Child Tax Credit Portal. Within that section at the bottom it will say Update your information in your profile with the your profile hyperlinked. The expanded credit was established in the American Rescue Plan signed into law in March.

The next deadline to opt out is Aug. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. You cannot claim tax credits and Universal Credit at the same time.

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin on July 15. Once you click through you will see a Payment Info section.

Irs Child Tax Credit Payments Start July 15

Irs Child Tax Credit Payments Start July 15

Services With Images Goods And Services Goods And Service Tax Best Accounting Software

Services With Images Goods And Services Goods And Service Tax Best Accounting Software

Advance Child Tax Credit Advctc Payments In July 2021

Advance Child Tax Credit Advctc Payments In July 2021

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Com

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Com

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Child Tax Credit Dates Ages Qualifications Eligibility And Everything You Need To Know Marca

Child Tax Credit Dates Ages Qualifications Eligibility And Everything You Need To Know Marca

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Tax Day Are Taxes Due Today 12 Tips For Last Minute Filers

Tax Day Are Taxes Due Today 12 Tips For Last Minute Filers

3 Quick Ways To See If You Re Eligible For This Week S Child Tax Credit Payment Cnet

3 Quick Ways To See If You Re Eligible For This Week S Child Tax Credit Payment Cnet

Monthly Child Tax Credit May Arrive As States End 300 Unemployment Boost

Monthly Child Tax Credit May Arrive As States End 300 Unemployment Boost

Five Facts About The New Advance Child Tax Credit

Five Facts About The New Advance Child Tax Credit

Irs Ctc How Do I Access The Irs Child Tax Credit Update Portal Ctc Up Id Me Support

Irs Ctc How Do I Access The Irs Child Tax Credit Update Portal Ctc Up Id Me Support

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Stimulus Update Here S When You Can Expect First Of Monthly Child Tax Credits Oregonlive Com

Income Tax Return Xml Efiler Xml File Itr Xml To Pdf Itr Xml File Upload Itr Xml File Free Download Itr Xml Income Tax Tax Return Income Tax Return

Income Tax Return Xml Efiler Xml File Itr Xml To Pdf Itr Xml File Upload Itr Xml File Free Download Itr Xml Income Tax Tax Return Income Tax Return

Child Tax Credit 2021 When Payments Start How To Opt Out

Child Tax Credit 2021 When Payments Start How To Opt Out

No comments for "Child Tax Credit Portal"

Post a Comment